SOC 1 Versus SOC 2 A Clear Comparison for Tech Leaders

At its core, the difference between SOC 1 and SOC 2 is pretty simple: SOC 1 is about financial controls, while SOC 2 is about security, availability, and related operational controls. The right choice isn’t about which one is “better.” It’s about which one is relevant to the service you provide and what your customers actually need assurance on.

Understanding the Core Purpose of SOC 1 vs SOC 2

When you’re wading into the world of compliance, getting the distinction between SOC 1 and SOC 2 right is the first, most critical step. Both are attestation reports created by the American Institute of Certified Public Accountants (AICPA), and both provide third-party assurance about a service organization’s controls. But they serve entirely different audiences and solve different problems.

A SOC 1 report—formally a mouthful: a Report on Controls at a Service Organization Relevant to User Entities’ Internal Control over Financial Reporting (ICFR)—is built for service providers whose operations could directly impact their clients’ financial statements. Think of it as a report for your customer’s CFO and their financial auditors.

On the other hand, a SOC 2 report is structured around the AICPA’s Trust Services Criteria (TSC). It zeroes in on a company’s non-financial controls related to security, availability, processing integrity, confidentiality, and privacy. This is the go-to report for tech companies like SaaS platforms, cloud hosting providers, and data centers.

A Quick Comparison

To really nail down the differences, let’s look at their primary focus and who’s actually reading these reports. This quick breakdown sets the stage for a much deeper dive into their specific criteria and common use cases.

| Attribute | SOC 1 Report | SOC 2 Report |

|---|---|---|

| Primary Focus | Internal Controls over Financial Reporting (ICFR) | Security, Availability, & other Trust Services Criteria |

| Key Question Answered | Are your controls protecting the integrity of my financial data? | Are your systems secure and is my operational data protected? |

| Typical Audience | Client CFOs, Controllers, Financial Auditors | Client CISOs, Security Teams, Compliance Officers |

| Governing Standard | Statement on Standards for Attestation Engagements (SSAE 18) | AICPA’s Trust Services Criteria (TSC) |

Here’s a simple way to think about it: ask yourself, “Does my service directly touch my client’s money or financial records?” If the answer is a clear yes, you’re probably on the SOC 1 path. If your service is all about storing, processing, or securing client data, SOC 2 is the industry standard.

Getting this fundamental distinction right from the start is how you make a confident, strategic decision. It ensures you invest in the right audit—one that meets customer demands, satisfies contracts, and builds trust where it counts. Now, let’s dig into the details.

Deconstructing the Differences in SOC 1 and SOC 2 Audits

It’s easy to say SOC 1 is for finance and SOC 2 is for security, but that’s a dangerously oversimplified view. The real differences are baked into the audit process itself—from scope and criteria to the final report’s audience. Picking the wrong one isn’t just a misstep; it’s a costly investment in the wrong kind of assurance.

The core distinction starts with the audit’s focus. A SOC 1 audit has a laser focus on controls that could directly impact a client’s financial statements. A SOC 2, on the other hand, casts a much wider net, digging into controls across security, availability, and other operational principles.

Audit Scope and Governing Criteria

A SOC 1 audit revolves around control objectives that you, the service organization, define with your auditor. These aren’t generic security goals; they are custom-built to address risks to your clients’ financial reporting.

Think of a payroll processor. Their SOC 1 report would focus on objectives like ensuring the accuracy of payroll calculations, tax withholdings, and fund disbursements. It’s all about the money.

A SOC 2 audit is completely different. It’s not custom-built; it’s measured against a predefined framework: the Trust Services Criteria (TSC). Every single SOC 2 audit must cover the Security criterion. From there, you can add others that matter to your customers:

- Availability: Proving your system is up and running as promised.

- Processing Integrity: Verifying that system processing is accurate, complete, and on time.

- Confidentiality: Showing how you protect data designated as confidential.

- Privacy: Addressing how you handle personal information according to privacy commitments.

This is the fundamental split: SOC 1 is tailored to financial impact, while SOC 2 uses a standardized framework to assess your entire tech and data governance environment.

For a quick reference, here’s how the core attributes stack up.

Key Differentiators SOC 1 vs SOC 2

| Attribute | SOC 1 Report | SOC 2 Report |

|---|---|---|

| Core Purpose | Assurance over controls impacting a client’s financial reporting. | Assurance over controls related to security, availability, confidentiality, processing integrity, and privacy. |

| Governing Criteria | Custom Control Objectives defined by the service organization. | Standardized Trust Services Criteria (TSC) from the AICPA. |

| Primary Audience | A client’s financial auditors, CFOs, and finance teams. | A client’s security teams, compliance managers, and vendor risk assessors. |

As you can see, the reports are built for entirely different people with entirely different jobs to do.

The Audience and Their Objectives

Thinking about who will actually read the report is the clearest way to settle the soc 1 versus soc 2 debate.

A SOC 1 report is written for your client’s financial auditors and finance teams. They use it to gain confidence in your controls as part of their own financial statement audits, officially known as their Internal Control over Financial Reporting (ICFR). It saves them from having to audit your systems directly.

In contrast, a SOC 2 report is built for a technical audience. We’re talking about your client’s CISO, security engineers, and vendor risk managers. They care less about transaction accuracy and more about your security posture, uptime, and data protection practices.

The real difference is the question each report answers. A SOC 1 answers, “Can my financial auditors rely on your controls?” A SOC 2 answers, “Can my security team trust you to protect our data?”

Report Content and System Description

These different goals naturally lead to completely different reports. The system description in a SOC 1 details the flow of financial transactions—how data that ends up on a balance sheet is initiated, authorized, and processed.

A SOC 2 system description is a deep dive into your technology stack. It outlines the infrastructure, software, people, and data through the lens of the chosen Trust Services Criteria, giving a complete picture of your security architecture.

The number of controls reflects this difference in scope. While some SOC 1 reports might have just a few core control objectives, it’s common to see them exceed 200 individual controls in larger financial service providers. SOC 2 reports have followed a similar trend, with many companies now implementing over 150 security controls to satisfy the TSC. For a closer look at how these reports are put together, you can find great information on the key differences between SOC 1 and SOC 2 reports.

Ultimately, this choice isn’t just about checking a box. It’s about giving the right people the right proof that you can be trusted with what matters most to them.

Choosing Your Audit Based on Real-World Business Scenarios

Knowing the technical differences between SOC 1 and SOC 2 is one thing, but the real decision boils down to your business model. The service you provide and who you sell to will ultimately point you down the right compliance path. Let’s get out of the weeds of theory and look at some tangible, real-world examples.

This isn’t just an academic exercise. The demand for third-party assurance is exploding. The global market for SOC Reporting Services was valued at USD 5.392 billion and is projected to hit USD 10.47 billion by 2030. Unsurprisingly, IT and security applications make up the biggest slice of the pie for SOC 2 adoption at 33% of the market, showing just how table stakes these reports have become. You can read more about the growth of the SOC reporting services market to see where the industry is heading.

When a SOC 1 Report Is Non-Negotiable

A SOC 1 report is the only option when your service directly impacts your clients’ Internal Control over Financial Reporting (ICFR). Put simply, if a bug in your system could cause a material error on your client’s financial statements, their auditors are going to demand a SOC 1. It’s not a “nice-to-have”—it’s a requirement for their own audit procedures.

Think about these classic SOC 1 use cases:

- Payroll Processors: These platforms calculate wages, manage tax withholdings, and trigger direct deposits. Any mistake has an immediate and direct financial consequence.

- Loan Servicing Companies: They handle everything from mortgage payments and interest calculations to escrow accounts. The accuracy of these transactions is the bedrock of a financial institution’s reporting.

- Claims Administrators for Insurance: Processing insurance claims means verifying, approving, and paying out funds—all activities that flow straight to the insurer’s financial books.

In every one of these scenarios, the service organization is basically an outsourced part of the client’s financial operations. The client’s auditors depend on the SOC 1 report so they don’t have to audit your controls themselves.

Key Takeaway: If your platform moves money or spits out data that lands on a balance sheet or income statement, you’re a prime candidate for a SOC 1 audit. The entire conversation begins and ends with financial impact.

Scenarios Demanding a SOC 2 Report

The second the conversation pivots from financial accuracy to data protection and system uptime, you’re in SOC 2 territory. For most tech companies today, the biggest customer concern isn’t about transaction integrity—it’s about the security of the data they’re handing over to you. This is the heart of the soc 1 versus soc 2 debate for SaaS and cloud companies.

Here are some common business models where a SOC 2 is the industry standard:

- SaaS Platforms: Whether it’s a CRM, project management tool, or marketing automation software, your customers need proof that their business data is safe and that your platform will be there when they need it.

- Cloud Hosting Providers: Companies like AWS, Google Cloud, and Azure go through exhaustive SOC 2 audits to prove the security and availability of the infrastructure they provide.

- Managed IT Services: Any MSP with access to client networks and systems has to show they have rock-solid controls over security, confidentiality, and availability to even get in the door.

Navigating the Overlap in FinTech and HealthTech

So what happens when your service involves both financial data and sensitive personal information? This is the reality for companies in heavily regulated spaces like FinTech and HealthTech, where you often need both reports to keep different stakeholders happy.

A FinTech company with a payment processing platform might need:

- A SOC 1 to satisfy banking partners and their auditors that transaction controls are sound.

- A SOC 2 to prove to enterprise customers that the platform’s security is strong enough to prevent data breaches.

Likewise, a HealthTech company that provides medical billing services is juggling financial transactions (claims) and protected health information (PHI). Financial auditors will ask for the SOC 1, but a hospital’s CISO will demand a SOC 2 to verify your data protection controls. In these complex situations, getting both audits isn’t overkill—it’s a strategic move to cover all your bases and shorten your sales cycle.

Planning Your Audit Timeline and Budget

Kicking off a SOC audit is a major commitment, both in terms of time and money. The choice between SOC 1 and SOC 2 has huge downstream effects on your project plan and budget, especially when a big enterprise contract is on the line.

Getting a handle on these demands upfront is the key to setting realistic expectations and keeping the process on track. A classic mistake is underestimating the internal hours required, which almost always leads to blown timelines and surprise costs.

The biggest variables are the report type (Type I vs. Type II) and the sheer scope of the audit. A SOC 1 can often be quicker, but a SOC 2, with its deeper dive into operational security, usually demands a lot more prep work.

Estimating Your Audit Timeline

The real timeline driver is the difference between a Type I report—a snapshot in time—and a Type II, which is a longer look at how your controls actually work over a period.

A SOC 1 Type I report can often be wrapped up in one to three months, but that assumes your controls are already documented and working. A SOC 1 Type II, on the other hand, needs to observe those controls for a minimum of six months (sometimes up to 12), which naturally extends the timeline.

SOC 2 reports are usually a much heavier lift. A SOC 2 Type I can take up to six months just to prepare for, given the complexity of the security controls. A SOC 2 Type II can easily stretch from six months to a year, or even longer. This intensity is why only about 7% of startups with less than $1 million in funding have a SOC 2, while that number jumps to 45% for those with over $100 million.

Pro Tip: Don’t even think about starting an audit without a readiness assessment. This is a pre-audit checkup that finds all your control gaps before the real audit begins. Fixing these issues early is the single best way to avoid delays and get a clean report.

For a more detailed breakdown of how to schedule everything from readiness to the final report, check out our guide on the SOC 2 audit timeline.

Key Factors Driving Your Audit Costs

When you’re building a budget for a SOC 1 or SOC 2 audit, the auditor’s quote is just the beginning. You have to account for internal time, new tools, and potential remediation costs.

Here’s what really drives the price tag:

- Audit Scope: A SOC 2 audit covering all five Trust Services Criteria is going to cost a lot more than one focused just on Security. In the same way, a SOC 1 with dozens of complex control objectives is pricier than a simple one.

- System Complexity: Auditing a straightforward, single-product SaaS company is one thing. Auditing a multi-platform environment with tons of integrations and data flows is another beast entirely.

- Control Count: The more controls you have, the more testing the auditor has to do. More testing directly translates to more hours and a higher bill.

- Audit Firm Selection: Big Four firms come with premium price tags. Specialized boutique firms are often much more affordable. Your choice here depends on your budget, if you need the brand name, and whether you require deep industry expertise.

- Internal Resources: Don’t forget to factor in your own team’s time. The hours spent on prep, gathering evidence, and fixing gaps is a huge “soft cost” that many companies miss in their initial budget.

It’s crucial to look beyond the audit fee itself. For a really detailed look at all the associated expenses, this is a great resource on understanding the real SOC 2 certification cost. Planning for these factors helps you build a budget that won’t give you any nasty surprises, turning compliance from a necessary evil into a real strategic asset.

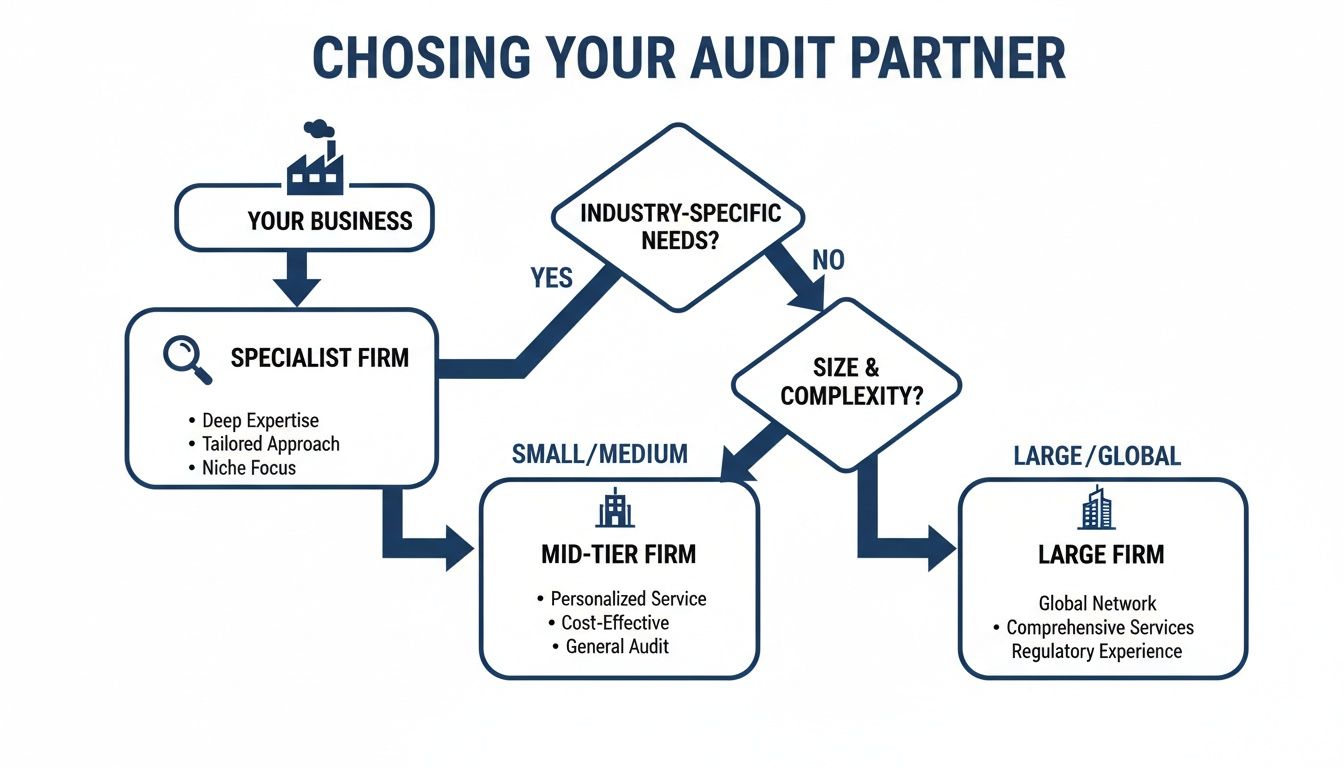

How to Select the Right Audit Partner

Picking an auditor for your SOC 1 or SOC 2 report isn’t just a procurement task. It’s a strategic choice that will absolutely define the cost, timeline, and quality of your audit. The right partner is a guide who helps you navigate the mess, while the wrong one leads to painful delays and a final report that won’t impress anyone.

Your first big decision comes down to choosing between a massive, traditional firm—think Big Four—and a specialized boutique. There’s no single “right” answer here. The best fit depends entirely on your company’s situation, budget, and who you’re selling to.

Big Four Firms vs Specialist Boutiques

Large, globally known audit firms bring instant brand recognition. For certain enterprise customers or in heavily regulated spaces, seeing that big name on the report can carry a lot of weight and might even be an unwritten rule. But that prestige comes with a premium price tag and rigid, slow-moving processes.

Specialist firms, on the other hand, live and breathe specific niches like SaaS, FinTech, or HealthTech. They usually offer more hands-on support, much faster turnarounds, and clearer, more competitive pricing. For a startup or mid-market company, a boutique partner who actually understands your tech stack and business model is almost always more effective.

The decision isn’t just about brand versus budget. It’s about alignment. A specialist firm focused on FinTech will have a far deeper grasp of the specific risks and controls relevant to your SOC 1 than a generalist auditor ever could.

Key Criteria for Your Selection Process

Beyond the firm’s size, you need to dig into the practical factors that make or break the partnership. Rushing this decision can lock you into a relationship that’s a constant headache. If you want a structured way to evaluate your options, check out this detailed advice on how to choose a SOC 2 auditor to build out a solid checklist.

When you’re interviewing potential partners, get specific with your questions about their experience, process, and how they actually support their clients.

Here are the critical areas to investigate:

- Industry Expertise: Ask for case studies or references from companies just like yours. Do they get your business? An auditor who has seen your exact challenges before can give you priceless advice.

- Responsiveness and Support: You will have a million questions during the audit. Ask about their communication process and what their typical response times look like. A responsive partner keeps small issues from snowballing into major roadblocks.

- Speed to Report: How long does their entire process take, from the first readiness check to delivering the final report? A firm’s efficiency can be the make-or-break factor when a huge sales deal is waiting on that SOC report.

- Pricing Transparency: Demand a clear, all-inclusive quote. Are readiness assessments, remediation help, and re-testing included? Hidden fees can blow up your budget, so getting clarity upfront is non-negotiable.

Making the right choice in the soc 1 versus soc 2 journey means finding an auditor who acts like a true partner. By focusing on industry alignment, responsiveness, and transparency, you can transform your audit from a required pain into a powerful tool for building customer trust and getting a leg up on the competition.

Your Decision-Making Checklist: SOC 1 vs. SOC 2

Deciding between SOC 1 and SOC 2 can feel overwhelming, but it boils down to answering a few fundamental questions about your business and your customers. This isn’t about guesswork; it’s about building a compliance strategy that aligns with what your customers actually need.

Let’s walk through the key questions that will point you toward the right report—or confirm if you need both.

1. Does Your Service Directly Impact a Client’s Financial Reporting?

This is the most critical question. If your platform processes transactions, manages data, or performs any function that could end up on your client’s financial statements, a SOC 1 is almost certainly on the table. Think of it this way: your service is a direct extension of their financial controls.

- If Yes: Your clients’ financial auditors will demand a SOC 1 report to complete their own audits. There’s really no way around it. This applies to payroll processors, loan servicing platforms, and revenue management tools.

- If No: If your service doesn’t touch financial reporting—maybe you offer a data storage solution or project management software—then a SOC 1 isn’t the right fit.

2. What Are Your Customers Actually Asking For?

Forget theory. The real driver for your compliance roadmap is what your customers are demanding in their security questionnaires and vendor contracts. Are their questions about data security, uptime, and privacy? Or are they hyper-focused on transaction integrity and financial controls?

The Critical Insight: Customer demands are your clearest signal. If enterprise prospects consistently gatekeep deals behind proof of your security posture, a SOC 2 is no longer a “nice-to-have.” It becomes a core sales enablement tool.

3. Do You Handle Sensitive, Non-Financial Data?

If your business is built on storing, processing, or transmitting sensitive customer data—like personal information, intellectual property, or confidential business analytics—your focus shifts squarely to SOC 2. The primary risk you’re managing for clients is operational and security-related, not financial.

A SOC 2 report is built on the Trust Services Criteria, which gives your customers concrete assurance around the things they truly care about:

- Security: How do you shield their data from unauthorized access?

- Availability: Can they count on your service being up and running when they need it?

- Confidentiality: What specific safeguards are in place to protect their sensitive information?

Answering these questions not only clarifies which report you need but also helps you choose the right audit partner. This decision tree breaks down the choice between a nimble, specialized firm and a larger, more traditional one.

As the flowchart shows, specialized firms are often a better fit for tech companies needing deep industry knowledge and faster timelines, while larger firms might be chosen for their global brand recognition in more traditional sectors.

4. What Are Your Competitors Doing?

Finally, take a hard look at your direct competitors. If the market leaders in your space all have SOC 2 reports featured prominently on their security pages, it establishes a clear baseline expectation for buyers.

Lacking that same level of assurance can quickly become a competitive disadvantage. It makes it harder to win enterprise deals and build trust with savvy, security-conscious customers who now see SOC 2 as table stakes.

Common Questions, Answered

Even with a clear side-by-side comparison, some practical questions always pop up when you’re in the trenches deciding between SOC 1 and SOC 2. Here are the answers to the most common ones we hear.

Can a Company Have Both a SOC 1 and a SOC 2 Report?

Absolutely. In fact, it’s pretty standard for companies operating in regulated spaces like FinTech or HealthTech. You’ll often find a business needs a SOC 1 report to give a client’s financial auditors the green light on transaction processing controls.

At the same time, that very same company will need a SOC 2 report to get through the security and vendor risk reviews from their enterprise customers. Those teams care less about financial reporting and more about data protection, system uptime, and security. Getting both reports isn’t redundant; it’s a smart way to satisfy two completely different audiences.

Key Insight: Having both reports is a strategic move to cover all your bases. The SOC 1 report handles the financial integrity questions for auditors, while the SOC 2 tackles operational security for the technical buyers and legal teams, ultimately helping you close deals faster.

Is SOC 2 More Difficult to Achieve Than SOC 1?

Generally, yes. While the actual difficulty depends on the scope you choose, a SOC 2 audit is usually a heavier lift for most tech companies. Why? Because the Trust Services Criteria (TSC) for SOC 2 cast a much wider net, covering a broad range of operational and security controls across your entire system.

A SOC 1 audit, on the other hand, is laser-focused on a narrow set of control objectives tied directly to financial reporting. A SOC 2 forces you to implement, document, and prove the effectiveness of controls for things like security incident response, rigorous access control, and system monitoring—all of which are notoriously more complex to get right.

How Often Do SOC Reports Need to Be Updated?

Both SOC 1 and SOC 2 Type II reports should be on an annual renewal cycle. Think of it like a subscription. A Type II report covers a specific window of time, usually between 6 to 12 months, and your customers will expect a fresh one every year to prove your controls haven’t slipped.

Letting your audit cycle lapse is a huge red flag during vendor reviews and can even put you in breach of contract. Sticking to an annual cadence shows you’re serious about maintaining a strong control environment.

For a deeper dive into the broader regulatory world beyond just SOC standards, you can find additional compliance insights and see how other frameworks fit into the picture.

What Is the Difference Between SOC 2 and SOC 3?

The biggest difference comes down to the intended audience and the level of detail shared.

A SOC 2 report is a restricted document. It’s the full, unabridged story, packed with detailed descriptions of your systems, the specific controls you have in place, and the auditor’s own testing procedures and results. You only share this under an NDA with customers and prospects who need that deep level of assurance.

A SOC 3 report is the public-facing, general-use summary of your audit. It gives the auditor’s official opinion on whether you met the Trust Services Criteria but leaves out all the sensitive, nitty-gritty details about your internal controls and testing. This makes it a perfect marketing asset to post on your website.

Navigating the complexities of SOC 1 vs SOC 2 and finding the right audit partner can be a significant challenge. SOC2Auditors simplifies the process by matching you with vetted auditors based on your specific industry, budget, and timeline, ensuring you get the right report without the stress. Find your perfect SOC auditor match today.