How to Choose From the Top IT Audit Companies

Choosing an IT audit partner is more than just a compliance checkbox—it’s a critical business decision that directly impacts customer trust and your ability to close deals. These firms provide the independent, third-party proof of your security controls, which has become a table-stakes requirement for competing in SaaS, FinTech, and HealthTech. For leadership, picking the right auditor isn’t a cost center; it’s an investment in a strategic partner who can harden your security and speed up your sales cycle.

Understanding the Role of IT Audit Companies

At their core, IT audit companies are independent validators. They measure your organization’s internal controls against established security frameworks, most commonly SOC 2, and issue a formal report attesting to your security posture. Think of them as the objective referees who prove you actually do what your security policies say you do.

This kind of verification isn’t a “nice-to-have” anymore. Enterprise customers, especially in regulated industries, won’t even start a serious sales conversation without seeing a SOC 2 report. That report becomes a key sales asset, proactively answering hundreds of security questionnaire questions and shrinking deal cycles.

Core Services and Business Impact

The work these firms do goes way beyond just ticking boxes. A good auditor brings real strategic value, helping you find and fix security weaknesses before they turn into a full-blown crisis. Their main services usually fall into three buckets:

- SOC 2 Readiness Assessments: A dry run before the real audit. The firm stress-tests your controls, finds the gaps, and gives you a clear roadmap to get ready for the main event.

- SOC 2 Type 1 Audits: This report looks at the design of your security controls at a single point in time. It’s proof that you have a solid security foundation in place.

- SOC 2 Type 2 Audits: The gold standard. This is a much deeper look at the operational effectiveness of your controls over a period of time, usually 6-12 months, proving your security program works consistently.

The demand for this is exploding. The market for SOC reporting services was valued at USD 5.39 billion in 2024 and is on track to hit USD 10.47 billion by 2030—that’s a 12.3% compound annual growth rate. You can read the full research about the expanding SOC reporting services market.

From Compliance Burden to Strategic Asset

It’s a common mistake to see an IT audit purely as a cost. When you find the right partner, that compliance line item transforms into a powerful business driver. A smooth audit process and a clean report deliver tangible benefits that make the investment a no-brainer.

| Audit Phase | Strategic Value |

|---|---|

| Readiness | Forces you to improve internal security and get operationally mature. |

| Type 1 Report | Opens the door to initial sales talks with enterprise clients. |

| Type 2 Report | Closes bigger contracts and sails through vendor security reviews. |

| Ongoing Audits | Builds a lasting reputation for security and deepens customer trust. |

Bottom line: IT audit companies provide the credibility you need to compete for—and win—the high-value customers that will grow your business.

Key Criteria for Evaluating IT Audit Firms

Choosing the right IT audit company is about more than just finding the lowest price. A cheap auditor who misses key details, doesn’t understand your business, or delivers a confusing report can cause more headaches than they solve. You’ll waste time, frustrate your sales team, and potentially lose deals.

The real goal is to find a partner who adds genuine value. You need a firm that gets both compliance frameworks and your business context. This means digging into their industry experience, the technical depth of their team, how they communicate, and the tools they use to make the audit process less painful.

Industry and Technical Expertise

An auditor’s experience in your specific industry—be it SaaS, FinTech, or HealthTech—is non-negotiable. A firm that already knows your world understands the common risks, customer expectations, and regulatory pressures you face every day. They provide relevant advice, not generic, one-size-fits-all recommendations.

Just as critical is the technical skill of the actual audit team. You need people who can have an intelligent conversation with your engineers about your cloud setup, CI/CD pipeline, and security stack. If they don’t get your tech, they can’t audit it effectively.

Key questions to vet their expertise:

- Industry Focus: Can you share some anonymized case studies from companies similar to ours in size and sector?

- Technical Chops: What’s the background of the auditors who will actually work on our account? Do they have real-world experience with our stack (AWS, GCP, Azure)?

- Credentials: Are the lead auditors Certified Public Accountants (CPAs)? Do they hold serious security certifications like CISA (Certified Information Systems Auditor) or CISSP (Certified Information Systems Security Professional)?

Audit Methodology and Tools

The firm’s process has a direct impact on your team’s workload and the project timeline. A modern, tech-forward firm will use specialized platforms to streamline everything from evidence collection to communication. This is a world away from the old-school auditors who still live in endless spreadsheets and email chains.

An auditor’s methodology should feel like a partnership, not an interrogation. Look for a firm that emphasizes clear communication, transparent project tracking, and tools that reduce the administrative burden on your team. Their process should make compliance easier, not harder.

When you’re evaluating firms, also look for specific framework knowledge. For companies going through SOC 2, an auditor’s practical guidance is a game-changer. The best partners have deep expertise in SOC 2 compliance and can help you build a security program that makes sense for your business.

Communication and Report Clarity

At the end of the day, the audit report is what you’re paying for. Its quality is everything. A poorly written or confusing report can kill sales cycles and create unnecessary friction with prospects. Always ask for a sanitized sample report to see how they present findings and structure their analysis.

Clear communication during the audit is just as vital. The best IT audit companies give you a dedicated point of contact, provide regular status updates, and have a clear process for answering questions. Radio silence from your auditor is a major red flag that can lead to missed deadlines and massive frustration.

Before signing anything, get clarity on these points:

- Support Model: Will we have a dedicated project manager we can actually reach?

- Responsiveness: What are your guaranteed response times for questions during the audit?

- Reporting: Can we see a sample report to judge how you present findings and control effectiveness?

To help you organize your thoughts, here’s a quick checklist to guide your conversations with potential audit partners.

IT Audit Company Evaluation Checklist

This simple table summarizes the key areas to probe when you’re talking to different firms. Use it to keep your evaluations consistent and ensure you don’t miss anything critical.

| Evaluation Criterion | Key Question To Ask | Why It Matters |

|---|---|---|

| Industry Experience | How many clients do you have in the SaaS/FinTech/HealthTech space? | Niche expertise means they understand your specific risks and business model, leading to a more relevant audit. |

| Technical Proficiency | What’s the technical background of the team assigned to us? | Your auditors need to speak the same language as your engineers to assess cloud environments and security tools effectively. |

| Audit Methodology | What platform do you use for evidence collection and project management? | Modern tools save your team hundreds of hours compared to manual spreadsheet-and-email processes. |

| Responsiveness | What’s your average response time to client questions during an audit? | Slow communication is the #1 cause of project delays and frustration. Aim for a same-day or 24-hour SLA. |

| Report Clarity | Can we see a sanitized sample report? | The final report is your primary deliverable. It must be clear, professional, and easy for your customers to understand. |

| Team Continuity | Will the same team handle our future surveillance audits? | High auditor turnover means you have to re-educate a new team every year, which is inefficient and costly. |

| Pricing Structure | Is your pricing fixed-fee? What are the common triggers for change orders? | Avoid surprises. A clear, all-inclusive price prevents scope creep and unexpected bills down the line. |

By using a structured approach like this, you move beyond just comparing quotes and start evaluating true partnership potential.

For a deeper dive into what to look for, our guide on selecting the right SOC 2 audit firm provides more detailed questions and things to consider. Making the right choice involves a careful balance of these factors, ensuring the partner you select aligns with your long-term security and business goals.

Benchmarking Audit Costs and Timelines

When you start looking at IT audit companies, two questions always jump to the front of the line: “How much is this going to cost?” and “How long is this going to take?”

Getting straight, realistic answers is non-negotiable. You need them for budgeting, managing what your stakeholders expect, and weaving your compliance efforts into your go-to-market strategy. The price and timeline for a SOC 2 audit can swing wildly, so the first step is to get a handle on what drives those numbers.

The big three factors are your company’s size, how complex your systems are, and which Trust Services Criteria (TSCs) you include in your scope. A 25-person startup with a simple tech stack is going to have a very different experience than a 300-person company juggling multiple cloud environments and intricate data flows.

Understanding SOC 2 Audit Pricing

Audit fees are anything but one-size-fits-all. A SOC 2 Type 1 audit, which is basically a snapshot that checks if your controls are designed correctly at a single point in time, is the cheaper option. Think of it as a foundational step—proof that you have a solid security program on paper.

A SOC 2 Type 2 audit is a much deeper dive, and it costs more because of it. It tests whether those same controls are actually working effectively over a period of time, usually 6 to 12 months.

For a ballpark figure, most reputable sources put the audit-only fees for a SOC 2 Type 2 between $10,000 and $60,000. But that’s just the auditor’s bill. The total first-year investment—once you factor in readiness help, compliance software, pen testing, and your own team’s time—can easily range from $80,000 to over $350,000.

The “sticker price” of an audit is only part of the story. A cheap audit from an inexperienced firm can leave you with a confusing report that enterprise customers will reject flat-out. That ends up costing you far more in lost deals and wasted time.

To really benchmark properly, you need to look at different IT audit service pricing structures from several firms. I always recommend looking for auditors who offer fixed-fee pricing to protect yourself from surprise costs down the road.

For a personalized estimate based on your specific company profile, using an interactive tool like this audit cost calculator can give you a much clearer financial forecast.

Setting Realistic Audit Timelines

Just like with cost, the timeline for your SOC 2 depends entirely on where you’re starting from. If your security controls and documentation are already in good shape, the process will be much quicker. If you’re starting from scratch, you have to bake in a pretty significant “readiness” phase.

A typical audit journey breaks down into these key stages:

- Readiness Assessment (1-6 months): This is where you, often with a consultant or the auditor, find and fix the gaps in your controls. How long this takes is 100% dependent on your current security maturity.

- SOC 2 Type 1 Audit (1-3 months): This covers the fieldwork—where the auditor actually reviews your control designs—and the final report delivery.

- SOC 2 Type 2 Observation Period (3-12 months): This is the live monitoring window. Your controls have to be operating effectively throughout this entire time. A six-month period is a very common starting point for first-timers.

- SOC 2 Type 2 Fieldwork & Reporting (1-2 months): Once the observation period is over, the auditor comes back in to perform their testing and write up the final report.

All in, a first-time SOC 2 Type 2 can take anywhere from 5 to 20 months from the absolute start to the finished report. Planning for that full lifecycle is critical if you want to align your compliance work with your sales goals and product roadmap.

Specialist Boutiques Versus Big Four Auditors

One of the biggest decisions you’ll make is choosing between a specialist, boutique IT audit company and one of the “Big Four” global accounting firms. This isn’t just about a logo on your report; it’s a strategic choice that directly impacts your budget, timeline, and the entire audit experience.

Each model exists for a reason, and the right fit is all about your company’s stage, complexity, and goals. For most tech companies—especially startups and mid-market SaaS businesses—the big-name appeal of a Big Four firm can be tempting. But in reality, a boutique firm often delivers a more focused, responsive, and efficient audit, particularly for frameworks like SOC 2 where niche expertise is king.

The Case for Specialist Boutique Firms

Boutique firms live and breathe frameworks like SOC 2, HIPAA, and ISO 27001. Their auditors are typically senior-level pros who have spent their careers in the trenches of information security and compliance.

This deep specialization means they get the nuances of cloud environments, modern devops, and the specific security risks that tech companies wrestle with every day. You’re not just another client; you’re the client.

Their smaller size usually translates to more direct access to experienced partners and a more agile, less bureaucratic process. You’re far less likely to get handed off to a junior associate who is learning on your dime. This leads to faster answers, more practical advice, and a genuine partnership feel.

Key advantages often include:

- Deep Niche Expertise: They are masters of a few specific frameworks, not generalists trying to be everything to everyone.

- Greater Flexibility: Their processes can often be shaped around your company’s unique setup, not the other way around.

- Better Cost-Effectiveness: With lower overhead, their fixed-fee pricing is almost always more competitive.

- Senior-Level Attention: Your main contacts are seasoned auditors, not recent college grads.

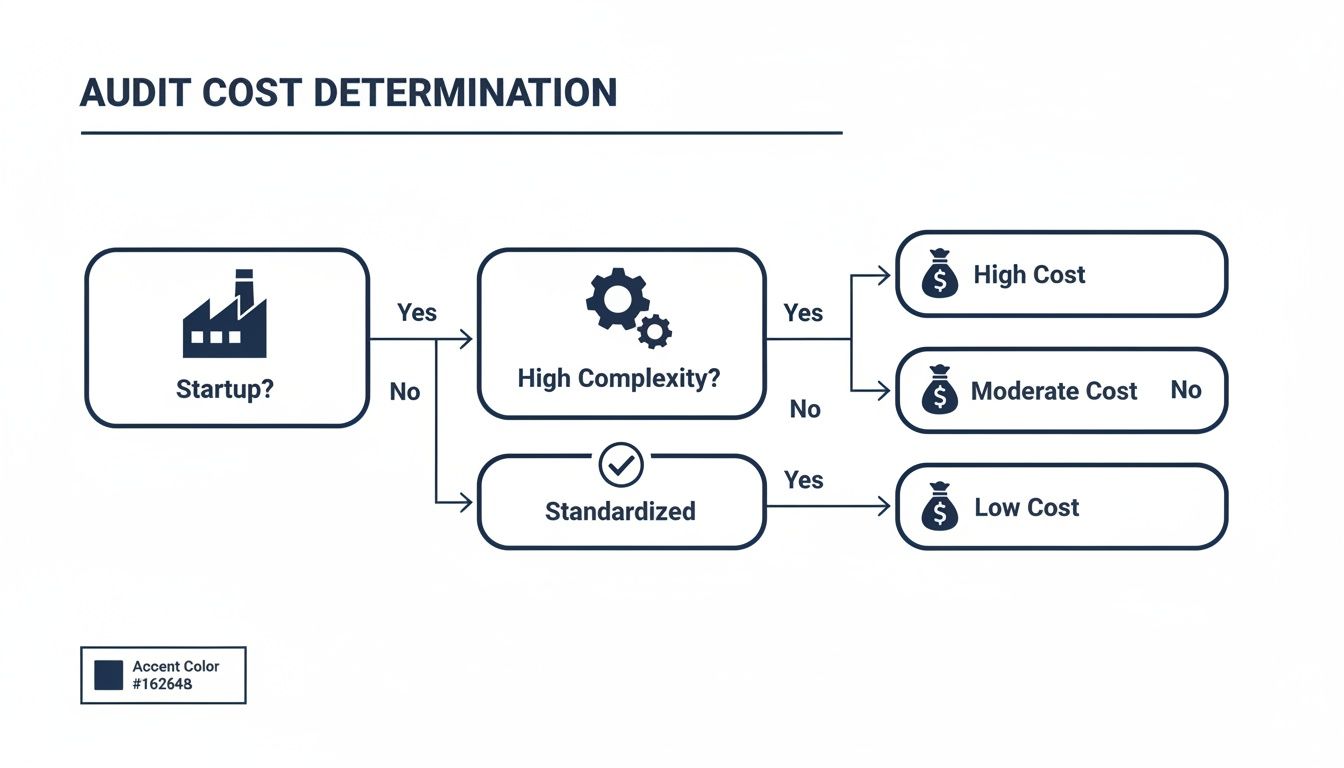

This flowchart shows how things like your company’s stage and complexity can influence what you should expect to invest in an audit.

As you can see, startups with lower complexity often find much more cost-effective solutions with specialists. For larger, more complex enterprises, the costs tend to scale up regardless of the firm you choose.

When the Big Four Make Sense

The Big Four firms—Deloitte, PwC, Ernst & Young (EY), and KPMG—bring unmatched global reach and brand prestige to the table. For massive, publicly traded enterprises or companies with incredibly complex international operations, their brand provides a level of assurance that stakeholders and boards of directors often demand.

Their primary strength is their ability to offer a huge, integrated suite of services that go way beyond a simple SOC 2 audit. If you need financial statement audits, tax advisory, and complex risk management consulting all under one roof, a Big Four firm is built for exactly that. Their global footprint is also a major plus for multinational corporations needing consistent audit services across different countries and regulatory landscapes.

For a Fortune 500 company, the integrated services and global brand recognition of a Big Four firm can be indispensable. For a Series B SaaS company, that same structure can feel slow, impersonal, and way too expensive for a focused SOC 2 audit.

But this scale comes with trade-offs. The teams assigned to smaller audit projects are often less experienced, and the rigid, standardized methodologies can feel clunky for agile tech companies. Costs are also significantly higher due to their massive overhead and brand premium.

Making the Right Choice for Your Business

The decision really comes down to a clear-eyed assessment of your needs. Don’t choose an auditor based on brand recognition alone; pick the partner that is best equipped to handle your specific situation.

Looking at them side-by-side can make the choice a lot clearer.

Comparison Specialist Boutique vs Big Four IT Auditors

This table breaks down the key differences to help you decide which path makes the most sense for your business.

| Attribute | Specialist Boutique Firms | Big Four Firms |

|---|---|---|

| Ideal Client | Startups, mid-market tech, SaaS | Large enterprises, public companies |

| Core Strength | Deep SOC 2/ISO 27001 expertise | Broad service portfolio, global brand |

| Service Model | High-touch, partner-led | Formal, structured, often junior-led |

| Pricing | More competitive fixed fees | Premium pricing, higher overhead |

| Flexibility | Agile and adaptable processes | Rigid, standardized methodologies |

For the vast majority of companies looking for a SOC 2 report to unblock sales deals, a specialist firm offers a more direct and efficient path to a high-quality audit report. Their focus, expertise, and client service model are simply better aligned with the needs of a growing tech business.

A Step-by-Step Guide to Selecting Your Auditor

Turning your evaluation criteria into a real-world selection process is where the rubber meets the road. It’s how you avoid guesswork and costly mistakes. A structured approach means you’ll find, vet, and sign with the right IT audit partner with confidence, making sure your investment actually pays off.

First things first: you have to define your audit scope. Before you even think about looking at IT audit companies, you need to know exactly what you’re auditing. Are you going for a SOC 2 Type 1 to check a box for a sales deal, or are you ready for the more rigorous Type 2? Which of the Trust Services Criteria—Security, Availability, Confidentiality, Processing Integrity, or Privacy—actually matter to the promises you’ve made to customers? Nailing down these answers makes your first calls with potential firms infinitely more productive.

Phase 1: Finding and Vetting Potential Firms

With your scope locked in, you can start building a list of reputable firms. Your goal is to create a longlist of five to seven potential partners. Instead of just Googling around, start with a curated list where you can filter by specialty and see verified metrics. Our auditor directory is a great place to build this initial list using real-world data.

Once you have that longlist, whittle it down to three or four top contenders for initial discovery calls. In these meetings, your job is to cut through the sales pitch. You need to understand their methodology, the actual expertise of their team, and what the client experience is really like.

Here are the critical questions to ask on those first calls:

- What is your audit methodology? What specific tools do you use for evidence collection?

- Can you share an anonymized list of clients in our industry and of a similar size?

- Will we get a dedicated point of contact? What’s your guaranteed response time?

- Is your pricing a fixed fee? What are the most common reasons you issue change orders?

Phase 2: Analyzing Reports and Checking References

After the initial calls, ask your top two or three firms for a sanitized sample audit report. This is single-handedly the best way to judge the quality of their work. A good report is clear, professionally formatted, and easy for a non-technical person to read and understand. If the sample report is a confusing mess, that’s a massive red flag that will cause headaches for your own customers later.

Next up: check their references. Don’t just settle for a list of their happiest clients. Ask to speak with a company that’s similar to yours in both size and industry. When you get them on the phone, ask specific questions about the audit process, how responsive the team was, and if they got hit with any unexpected costs or delays.

A firm’s willingness to provide relevant, high-quality references speaks volumes about their confidence. If they hesitate or only offer generic contacts, consider it a warning sign.

Phase 3: Making the Final Decision

Finally, it’s time to review the proposals and pricing from your finalists. Don’t just look at the sticker price; focus on the total value. A slightly more expensive firm that offers a dedicated senior team, a modern audit platform, and a clear, fixed-fee structure is almost always a better investment than a cheaper option that leaves you with a confusing process and surprise bills.

This structured approach is especially important when you realize how few companies have actually achieved formal certification. Recent data shows that only about 18% of SaaS companies have a SOC 2 or ISO 27001 certification. The gap is even wider for early-stage companies, where only ~7% of pre-seed and seed startups report SOC 2 compliance, compared to 45% of companies with over $100 million in funding. Discover more insights about these compliance benchmarks. This data makes it clear: a well-executed audit gives you a serious competitive advantage. By following a methodical process, you position your company to join the ranks of trusted, enterprise-ready vendors.

Your Top Questions About Choosing an Auditor, Answered

Picking an IT audit firm always kicks up a few crucial questions. Getting straight answers is the fastest way to cut through the noise and make a confident decision. We pulled together the most common questions we hear from founders, CISOs, and compliance leaders to give you the inside track.

Think of this as your cheat sheet for navigating the big milestones—from getting your timing right to knowing when (and how) to switch firms.

When Should We Start Looking for an IT Audit Firm?

You should start your search three to six months before you want the audit observation period to kick off. Seriously. Rushing this is probably the single biggest mistake we see companies make, and it almost always leads to picking the wrong partner or blowing past deadlines.

That much lead time gives you a realistic window to properly vet a few firms, sit through scoping calls, negotiate the contract, and actually get on your chosen auditor’s calendar. More importantly, it builds in a buffer for readiness work. If a gap assessment uncovers some ugly surprises, you’ll have time to fix them without pushing back your target report date.

What’s the Difference Between a Readiness Assessment and an Audit?

Think of a readiness assessment as a dress rehearsal, and the audit as opening night. A readiness assessment is a consultative project where a firm helps you find and fix control gaps before the formal audit begins. It’s collaborative and designed to get you compliant.

The audit, on the other hand, is the official, independent examination by an accredited CPA firm. Its job is to give an impartial opinion on whether your security controls are designed correctly (Type 1) or actually working over time (Type 2). They’re two distinct things, but a good readiness assessment is the best predictor of a smooth, successful audit.

Can We Switch Auditors Between a Type 1 and Type 2 Report?

Yes, absolutely. Switching it audit companies between a Type 1 and Type 2 report is not only possible, it’s a common and often smart move. Companies do it all the time to find a better price for the more intensive Type 2, get better service, or find a firm with deeper expertise in their niche.

Switching auditors won’t raise red flags with your customers, as long as there’s no gap in your compliance coverage. The key is a clean handoff of all your control documentation and evidence from the Type 1 to the new firm.

What Red Flags Should We Watch Out for When Vetting Firms?

A few warning signs can tip you off to an inexperienced or non-transparent firm. Be wary if an auditor:

- Gives you fuzzy pricing: Vague estimates or a flat-out refusal to provide a fixed-fee quote is a recipe for surprise costs down the road.

- Can’t provide relevant references: If they can’t connect you with a client that looks like you (similar size, same industry), they probably don’t have the right experience.

- Uses high-pressure sales tactics: A real partner educates you and helps you make a good decision. They don’t try to rush you into signing a contract.

- Fails to explain their methodology: They should be able to clearly walk you through their process and explain what tools they use to make evidence collection less painful.

One of the biggest red flags? A refusal to share a sanitized sample report. That’s their final product, and if they won’t let you see the quality of their work, you should walk away.

Finding the right IT audit partner shouldn’t feel like a shot in the dark. SOC2Auditors gives you verified data on 90+ firms, so you can compare real costs, timelines, and satisfaction scores to find the perfect auditor for your business. Find your ideal auditor at https://soc2auditors.org.